Understanding the basics of the Huff Retail Gravity Model.

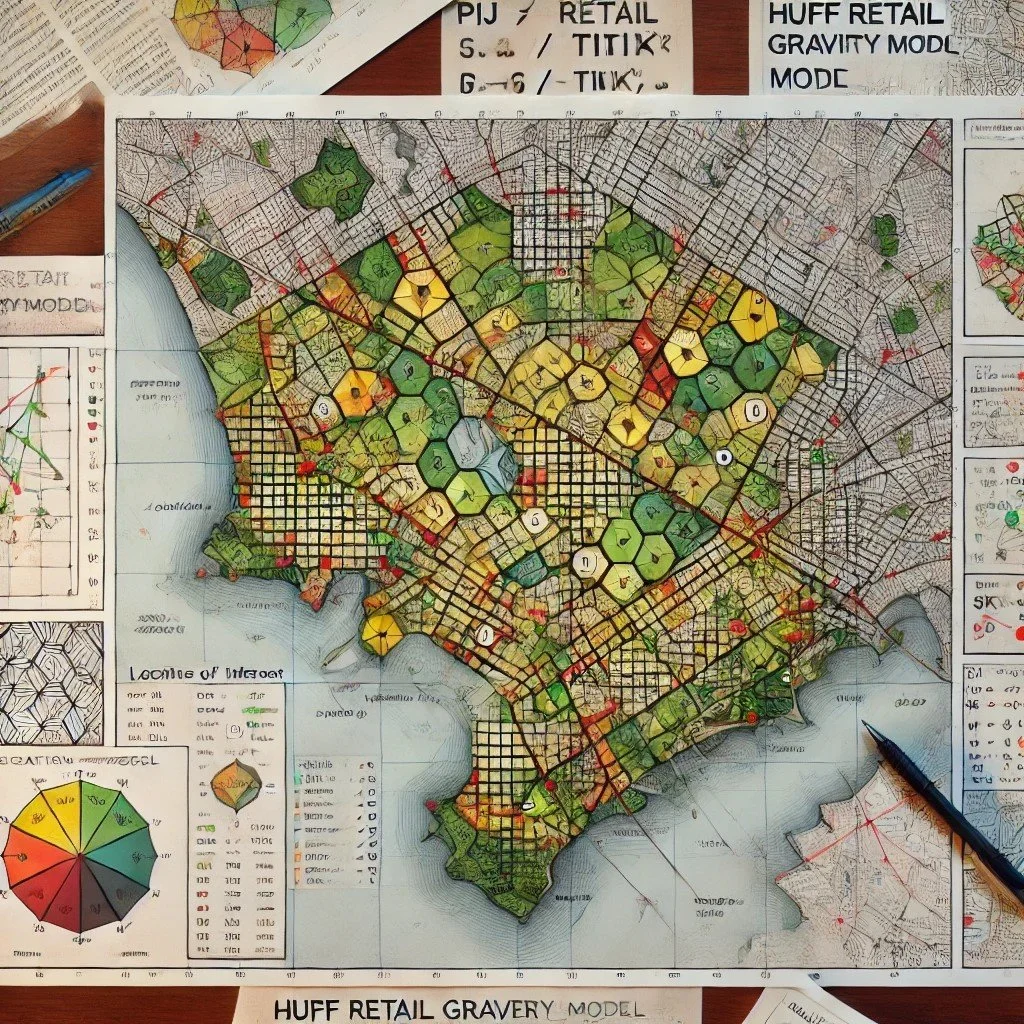

Sector Map Used in Identifying Households Clusters with the Huff Retail Gravity Model

I was first introduced to the Huff Retail Gravity Model around 1980. In its most simplistic form, it projects the probability that a consumer will shop one location over another location such as a mall, department store, or grocery store. As an example, if two identical grocery stores were located 10-miles apart on a straight highway with no traffic stops, 50% of the households at a center point between the two stores would shop one of the two grocery stores and 50% would shop the other.

That said, if the attractiveness of one location changed or if one of the two stores moved either closer to the center point or further away the probability of the consumer shopping one over the other will change.

This is all somewhat intuitive but more advanced modeling provides a deep understanding of existing trade areas, potential trade areas, property sales, and obtainable rents and eventually the value of a retail property.

Today, with geospatial modeling and mobile analytics a much deeper understanding of trade areas and potential markets can be analyzed.

If your eyes glaze over when you see a formula that looks something like this Pij =AαjDij-β /∑nk-1AαkDik-β you just joined the club.

But there good news for us non-data scientists as the Huff Model can be easily modeled in Excel with a high degree of accuracy. Variables such as distance, travel times, number of anchor stores, gross leasable area, and other factors of attractiveness can be easily integrated into the model to estimate patronage, capture of household income, property sales potential, and rent potential.

Conversely, with mobile analytics, geofencing, and geospatial modeling the existing trade areas of churches, mass merchandisers, cinemas, and shopping centers can be accurately mapped. The actual sales generated from a trade area can then be used to determine the market share of a particular property and then used to test out the Huff Model and its application to a new development.

There are some one click sources that provide sales projections. Some are relatively good, and others are way too gimmicky. I recommend to always understand the reason behind the rhyme and know exactly how things are calculated. As an example, one sources may provide dated zip code demographics for a trade area based on a 5-mile radius around a site. I think you must have current year projected household incomes and consumer profiles down to ZIP+4 data (areas as small as 8-households) for user defined polygons and not circles that do not recognize lakes, rivers, oceans, and other barriers to site.

In summary reliable benchmarks for market share, sales projections, and sustainable rents can be accurately projected for a planned new development, potential redevelopment, or major upgrade by working back and forth between a predictive model and the performance of an existing competitive properties.

I will soon be providing free tutorials, case studies, and downloadable spread sheets - here on my website to demystify the Huff Retail Gravity Model.